I’ll start by saying that this is going to get a tad messy. This article…

The 5 Finance Apps You Need On Your Phone

The Fintech revolution is upon us.

A product of technological developments pushing financial services into the next (or, arguably, the current) realm, ‘Fintech’ has spawned countless apps, websites, services and solutions, many of which are aimed at improving the financial life of consumers who have previously been at the mercy of the big banks.

Whether it’s reducing the time taken process loan applications or opening up investment opportunities that previously required a $10k minimum investment or making money transfers instantaneous, there’s something for everyone and, often, it’s better or cheaper than before.

Here I reveal on my Top 5 (and some additional worthy mentions), with a specific focus on Financial Wellness & Literacy

1. Revolut

Every time my Mum transfers me pocket money from the UK to Australia, we get a royal rogering by our respective banks. It could be the exchange rate, the spread, the fees, or sometimes the whole shebang.

What a load of old rubbish.

Enter Revolut – a “neo-bank” whose hypothesis is the rid the world of shoddy banking experiences provided by shoddy bankers, starting with international money transfers and building up their solution-stack from there.

There’s a bunch of these neo-banks hoovering up customers in the UK and a whole floatilla gearing up for battle here in Australia and posed to benefit from the Royal Commission into banking malpractises and more transparent sharing of data via Open Banking.

Check out also Up Bank, Volt and Xinja.

2. Stockspot

“Robo-advice” was a buzzword about 5 years ago when people came to the realization that passive (i.e. free) investment management yielded superior overall returns to active (i.e. expensive) managed funds, thus rending the snappily-dressed, expensively-officed fund manager largely redundant (see Warren Buffett’s wishes for his estate after he dies).

Chris Brycki and his robo-advice firm – Stockspot – was an early mover on this curve, aiming to offer smart, ethical, reasonably-priced investment management through a series of balanced funds that adhere to the Buffett-esque investing principles and aim for steady, modest returns in the 7-10% range year after year.

Your next crypto roller-coaster ride it’s not, but rest assured you’ll never need to HODL with Stockspot.

I interviewed Chris a couple of months back – learn about his investing philosophy & approach here.

3. Frollo

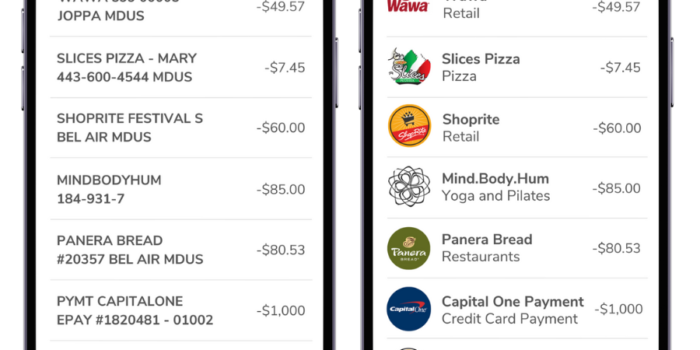

Want to see all of your various financial accounts (banking, savings, superannuation, investments, loyalty points) on a single dashboard so you know where you stand, rather than having to sign in to multiple apps or websites to get the info?

If, like me, your answer to this is “yes,” then you need an app like Frollo which does exactly that and a whole bunch more besides like financial goal setting and the creation of your own Frollo Score (based on your overall financial health).

I’ve linked around 17 of my accounts to Frollo and use it instead of my actual bank app when I want to see what balance is.

4. Raiz

First-mover advantage, a sweetly compelling value proposition and some shrewd marketing saw The-App-Formerly-Known-As-Acorns take off like a rocket upon launch in February 2016, stacking on 40,000 users in its first month and quickly becoming a Fintech darling in Australia.

The premise is simple and worthy, enabling millenials – I hate that term but it’s become ubiquitous & I’m a lazy writer – to get involved in stock market investing without large upfront amounts through “micro-investing” as they spend, thus promoting & increasing financial literacy in a hitherto underserved group.

I was an early evangelist and still am (with the vintage t-shirts to prove it).

See also WiSR for an alternate round-up solution focused on clearing your debts or Longevity for round-ups into your superannuation funds.

5. Spriggy

A pocket money app for kids. Works like a dream.

You set up the kids account, order them their own debit card and then link your own bank account via the “parent wallet” which pays the weekly pocket money into the kids account. Genius.

#superfitkid gets $5 per week for good behaviour & chores, and I can bribe (sorry, encourage) him with smaller amounts for ad-hoc tasks. He recently “charged” me a $20 top-up to his account for getting his haircut. On top on what I actually paid the hairdresser.

I’m not sure if this speaks more to his financial sass or my lack thereof.

They can also set up savings goals for larger purchases.

Summary

These aren’t the only Fintech apps out there disrupting a previously stodgy financial services world in Australia and beyond; there’s a swathe of others offering similar services with similarly lofty goals of increasing choice, opening hitherto closed doors, reducing costs, and improving financial wellness & literacy.

But these are products that I’ve used as a consumer and have solved a particular problem or itch for me and my family.

Importantly, they are products that I have no issues recommending. [Although, please do remember that I’m no financial advisor & don’t pretend to be one on the internet so be sure to do your own research.]

What’s exciting is that as A.I starts to be incorporated into these type of applications, the potential usefulness of them grows exponentially and, with that, so does the level of engagement. Think of something like a financial concierge in your pocket that knows everything about your finances and, therefore, can make personalised recommendations (on the fly) about what you should do with your money.

SFD