I’ll start by saying that this is going to get a tad messy. This article…

The Top 5 Personal Finance Apps of 2020

A little over a year ago I wrote this article (linked here) about the top 5 personal finance apps in Australia. Or rather, the ones I’m using the most and deriving the most benefit from using.

The Finance Apps folder on my phone has recorded record growth this year and now numbers 55, up from 43 last year. If only money contained in the the apps in the folder was on the same growth trajectory.

Off the top of my head the list looked something like this (in no particular order):

- Revolut

- Stockspot

- Raiz

- Spriggy

- Frollo

I listed a few other worthy contenders in each segment, and so the list could quite easily have be re-categorised thusly:

- Neobank

- Robo-advisor

- Round-up / micro-investing

- Pocket money / kids

- Personal Financial Management (PFM)

The post or article recently boomeranged back on my radar so I thought it timely to review the 40 or so Fintech apps on my phone and my usage of them to see how things are looking a year later.

Surely, during “the year that is 2020,” during which we’ve all been exposed to such “strange & unprecedented” times, things might have changed?

And…alas, no.

The list, a full twelve months on, looks exactly the same.

The same apps that blew my hair back twelve months ago, are the ones still doing so today. Strange. And unprecedented. But, then again, these are strange and unprecedented times.

But something in my initial findings didn’t sit right with me so I had another look and re-assessed how I felt about the apps, the utility I derive from them, and how they serve me.

And I wrote the list again, this time listening purely to my heart (with some contribution from the head).

It now looks more like this.

Drumroll please as I unfurl my Top 5 FinTech Apps for the year that is 2020.

1. Stockspot

Back in the early 2000’s I was a newly graduated commodity broker working in an environment I’d sort of fondly describe as being vaguely akin to a poor man’s Wolf Of Wall Street.

We laughed (when the nickel price soared), we cried (when the nickel price plummeted days later, forcing clients out of their highly leveraged margin trades), we howled in silent agony (when you were in the face with a missile during an important client pitch (over the phone), something which happened with surprising regularity).

It was no place for shrinking violets, but it did provide a training ground like no other.

The guys on the floor liked a flutter on some of the early tech-stocks of the day (actually, they didn’t mind a flutter on anything), making thousands of pounds at a time, trading in and out of stocks with great frequency.

Until the market hit the buffers. Or, more accurately, the (dot-com) boom was followed by a hearty bust.

The trauma (there really isn’t any other word) that followed was highly instructive, and is one reason why I gravitate towards the strategies employed by Chris Brycki and the team at Stockspot.

Eschewing the pain that comes with individual stock-picking, the Stockspot robo-advice model seeks to achieve consistent, above-average annual returns in the 8% -12% range combined smart asset-allocation to minimise any downside risk.

It’s a model favoured by the likes of Warren Buffett, the investing luminaries interviewed by Tony Robbins (in his excellent book Money: Master The Game, where he interviews investing titans) and, err, our very own, home-grown Barefoot investor, yet one that until the likes of Stockspot and Six Park etc established, weren’t readily available to the average Joe Schmo investor like you or I.

A recent makeover has left the app much easier on the eye, and much smoother to navigate, meaning you can see who’s who in the zoo in terms of your Stockspot portfolio which is great for the Stockspot kids account and teaching the youngsters about investing wisely and asset allocation strategies (but perhaps that’s just me?).

The refresh also enables viewing both your own account and the little chaps (or chap-ess’) account on the same dashboard which tells me that my thesises about #superfitkid being a) richer than me, and b) likely to become either a billionaire or a criminal mastermind, are both equally true. Sigh…

For those who haven’t encountered Stockspot yet, I interviewed Chris Brycki about Stockspot a while ago – here is the link.

2. Stake

Stake enables Aussies (and Brits. And South Americans) to easily trade US stocks, quickly democratising a previously tough market to get direct exposure to.

They’ve done this at great pace, conquering new territories and generating feverish excitement, loyalty & trading gains amongst their fans / customers who already number the X00,000’s.

The true cost of trading is not zero, but is low enough not to matter when the going is good. It’s a highly disruptive play that is already being imitated (almost certainly without the same success), but imitation is the highest form of flattery.

The day trading type of behaviour being exhibited by some users is, quite frankly, terrifying, but I don’t hold that against Stake, per se.

What I do love is the app design and functionality, specifically the watchlist feature that allows #superfitkid and I to keep tabs on a range of US shares and learn about them on an ongoing basis.

It means that when I tell the little tyke that he’d be better off being an owner of Apple stock rather than a consumer of their products, we can actually put it into practise after doing some research to compare Apple with some of its FAANG contemporaries.

This gives us something fun and educational to do together in a fun & easy-to-use format that works across generations and this is, in my opinion, a key ingredient of Stake’s secret sauce.

3. Raiz

There’s a lot going on in the Raiz app (aka The App Formerly Known As Acorns).

I’ve written plenty about the first cab off the FinTech app ranks in Australia and, whilst it was never really a scrappy upstart, thanks to the slick design from the get-go, it does sorta feel like we’re on version 2.0 or even 3.0 now. Baby’s all grown up.

There’s the original investing poster-child which is now joined by siblings in the rewards, super, kids, and, to some extent, PFM bracket. Not to mention the carbon offsetting ability. It’s quite a family.

All of which should result in an absolute imbroglio of an app, given the need for simplicity on a 4” x 3” screen.

And yet somehow Raiz manages to pull it off which is a testament to the designers cobbling it all together.

4. Motza

Like a comet in the night sky, Motza burst onto the scene this year with a cashback rewards app that delivered not insignificant rewards in stores where you’d be likely to shop anyway, like Coles or Shell or Big W (why do I love Big W so much?).

You simply linked your bank account (using a data aggregator or what will be known as an intermediary in the Open Banking era) and were rewarded with cashback within days after you shopped at the five or six merchants on the platform.

Simples, huh?

Since I shop at Coles most weeks and fill the car with fuel pretty much weekly (let’s assume each transaction is $100), that’s $5 of rewards a week at a 2.5% cashback rate just for giving up my transaction data.

Decent little data dividend, that.

It also kept me loyal to Coles and Shell. And kept me feeding my Big W habit (smirk emoji).

The problemo with this model comes if you’re funding the cashback yourself because the larger merchants are loathe to share an affiliate or cashback fee with you (because they don’t need to). In that case, you’ve got to be monetising the data you’re obtaining enough to more than cover the cost of acquiring it.

And, thus, like a talented rock-star dying at age 27 (RIP Janis, Jim, Jimi and Kurt), this fleetingly shining little FinTech app star disappeared a few weeks ago, leaving us wondering what might have been, but also $77.55 richer through my cashback total (which I promptly spent at Big W (double-smirk emoji).

The Motza app is closed but their waitlist is here – LINK

5. Spriggy

I’ve waxed lyrical about my love affair with Spriggy before (check links here and here). Been there, got the t-shirt etc. I even gave one to the CEO where I worked.

But it still hits the top 5 by delivering easily a top 5 experience for me and the little chap.

Unencumbered by much in the way of meaningful competition, Spriggy’s likeability quotient is off the charts, with members (parents & kids alike) becoming such loyal fans that it creates a rippling network effect.

Spriggy’s likeability has enabled its popularity to grow despite the app remaining very similar to the original incarnation.

Well, a new app is on the way and, having done some early beta testing with SFK, I’ve got to say we’re impressed. It’s still super-simple to navigate but the design seems to pop off the screen to create an experience that almost feels like it’s in 3D. Sounds weird, but that’s how it felt.

I really like the clearer delineation between card, savings and goals balances. The ‘jobs’ section is also more expansive: great for putting him to work.

6. Longevity

The final app making up the top five (which has generously stretched out to make room for a sixth) is Longevity – the round-up app tasked with bolstering our superannuation balances to ensure we don’t end up with a dreaded super gap whence retiring.

The average Australian male superannuation balance for males aged 40-44 is a terrifyingly lite $99,000, and makes me extremely nervous about hitting that bracket (in around, erm, 5 years time…eek).

By using round-ups to make additional super contributions, you can make a seriously meaningful difference to your retirement pot. The fact that Longevity is totally agnostic as to which super fund you’re actually paying into is the key ingredient here – none of the rigmarole of setting up a new fund or creating an account is required.

If it all seems a bit far fetched or you’re not sold on the difference your loose change could actually make, check out this calculator from SuperGuru and start crunching your numbers. You’ll be surprised:

https://www.superguru.com.au/ExternalFiles/calculators/small-change/index.html

The app itself is a beautific little piece of clean-lined simplicity and the settings dashboard is clever and inventive with the percentage rounded-up slider being a neat little feature.

Longevity is founder by powerhouse, Carla Harris, and champions equality in superannuation, making it both useful AND purpose-driven – a pretty powerful combination.

7. Frollo

I wouldn’t usually do this, but it is the only place in town a consumer can link accounts via Open Banking and thus experience this new method of sharing personal information for themselves.

For those fintech users & aficionados who are comfortable sharing their data using traditional ‘Electronic Data Capture’ methods, this might not blow their hair back.

But in terms of regulating, standardising & legitimatising a framework by which data can be shared and the ensuing consumer benefits being made more widely available, Open Banking is a game-changer.

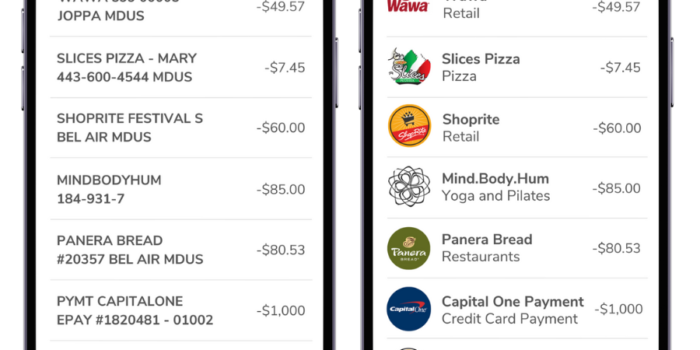

Making it sexy is the tough part of the equation and the Frollo app gives consumers super-clean, easily-digestible and consumer-friendly view into the future of personal finance apps and what will be other, key Open Banking use-cases.

I also like WeMoney in this space and tip them as one to watch.

Summary

And that’s a wrap, folks. What do you think of the list? What am I missing?

A couple of things to consider when considering this line-up.

1. Individual Preference

It’s a personal list based on the apps that serve me and my family well. I’m really keen to hear what I may have missed.

2. No BNPL providers or Lenders

It’s not that kind of list. It’s deliberately this way – those guys go alright on their own.

However, the arrival of apps like BeforePay (the app formerly known as Cheq (RIP Cheq, I’ll still flex your t-shirts)), FU Money, and I think, ultimately, XXXXXXX (name hidden at their request) are already blurring the lines between PFM and lending, acknowledging, as discussed at length in my previous article (link here), the difficulty in cracking the monetisation game without having either a) sky-high customer numbers or b) a lending proposition.

3. No Neos

Neobanks were the shiny Fintech star of 2019 and they’ve suffered even more than most of us in 2020.

I still don’t use any of them as my primary or salary bank and don’t see any benefit to doing so currently, and the features across all of them are a bit patchy.

UP’s design and execution seems some way ahead of the pack but there are still little annoyances that annoy like a paper cut. Or a mosquito. 86 400 has a well-rounded feature set and are lending so at least have money coming in.

So no neos make the cut for me this year.

4. Almost No PFM [ UPDATED ABOVE ]

I wrote 3,000 words on this a few weeks ago. Linked here.

Suffice to say, if your categorisation of something tells me I’m spending almost a thousand dollars a month on one category (when I’m not. It’s just miscategorised), then all of your summary insights are wrong and my interest in your app dwindles.

Categorisation (and cool, actually useful features that take PFM to the next level rather than just ‘spending insights’) are king in this jungle.

Sorry.

And that truly is it. My top 5 (or so) Fintech apps of the year for (the year that was) 2020.

No mas.