I’ll start by saying that this is going to get a tad messy. This article…

Managing Your Money In The FinTech Era – PFM 3.0 And Beyond

I was recently talking to a former start-up founder who got a promotion and is now an “entrepreneur”, meaning he hit the pay-dirt and sold up (or out), making a motza in the process. One of the cleverest Fintech-ers I’ve met, who, like the other four or five I’d class in that cohort, marches completely to the beat of his own drum, impervious to outside thoughts or factors.

In other words: zero stuffs given – and I mean that as the highest praise possible.

His business started life as a PFM tool and pivoted to being something else. I won’t say what, in the interests of protecting the innocent. Oh, and for the noobs, PFM stands for ‘personal financial management’.

Our discussion was around the trickiness of making PFM stick, or rather more precisely, making it stick as a sustainable, revenue-generating business model, something that is notoriously hard to do.

In short, how do you avoid the ‘Graveyard of PFM’, the notoriously wide chasm that, like the event horizon of a Black Hole, can start to drag you in slowly but alarmingly quickly without you even realizing what’s going on.

Many a start-up has perished in these dark & stormy waters, whilst a relatively small few have grown & thrived.

Before we delve into some reasons why the PFM space is a tough nut to crack, a little potted history follows to provide context.

What Is PFM?

PFM (or personal financial management) generally refers to a broad set of functionality centered around providing consumers, the regular Joe Schmos like you & I, more control & visibility over our financial health.

Instead of monthly bank statements, quarterly investment portfolio reports, and annual superannuation (pension) statements (either in paper form or on the individual websites of each financial provider), we can now tap into the FinTech evolution and take advantage of something called “account aggregation” to see all of our financial accounts in a single dashboard via the web or, more commonly now, through an app.

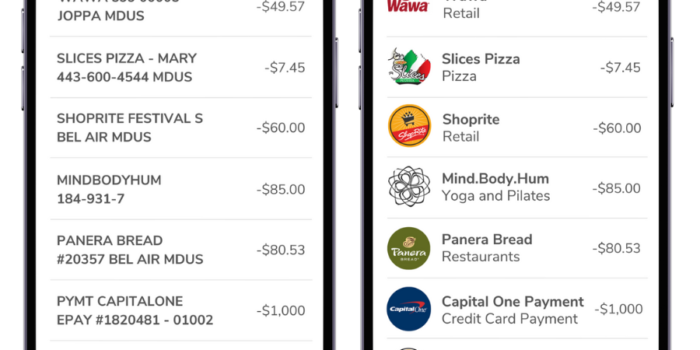

Additional features like transaction categorization & enrichment would feed into spending insights (think: have I been overdoing the avo on the toast this month (snooze)?) and other budgeting tools.

Banks in the US had been dabbling with this for a while, as had Microsoft’s Money and Quicken, but it was a small startup called Mint that was the first real leader in the PFM space, powered by the O.G of account aggregation, Yodlee (my former employer).

Through a mix of exemplary product execution, viral marketing and a GFC-related flight to financial awareness (not dissimilar to what we’re seeing now, perhaps), Mint was able to acquire 1m users in a 10 month period and wound up being sold to Intuit for $170m after three years in existence.

PFM in Australia

In Australia, ANZ Bank was the first to the party with their Money Manager App, again powered by Yodlee, who were the only option in Australia at the time.

But then something extraordinary happened. Two whip-smart friends got fed up with managing their finances in colour-coded excel spreadsheets and, presumably having seen the success of Mint, decided to build their own PFM tool. Not only that, they decided that they didn’t want to pay anyone else for account aggregation so they built their own. Clever, huh.

Pocketbook took off like a rocket and picked up customers at Mint-like levels (sort of), which for an Australian population is ridiculous. What’s more, Pocketbook users were such loyal, rabid fans that there would be circa 400k advocates evangelizing about the app on social media and personal finance forums and more than prepared to forgive any slight flaws in the product.

Minor limitations in the categorization engine, for example, actually increased user-engagement as people spent more time in-app fixing up some of their un-identified spending. Bingo – easy runs!

Pocketbook later sold to FinTech unicorn, Zip, and now resides there, having recently undergone a rebrand and relaunch.

Two other notables were seeded around the same time, Frollo & Money Brilliant, with the former, in particular, firmly focused on financial-wellness, inclusion & literacy.

Frollo was recently snapped up by NextGen, having executed pretty flawlessly on an Open Banking & beyond strategy, whilst Money Brilliant was absorbed into AMP a few years ago.

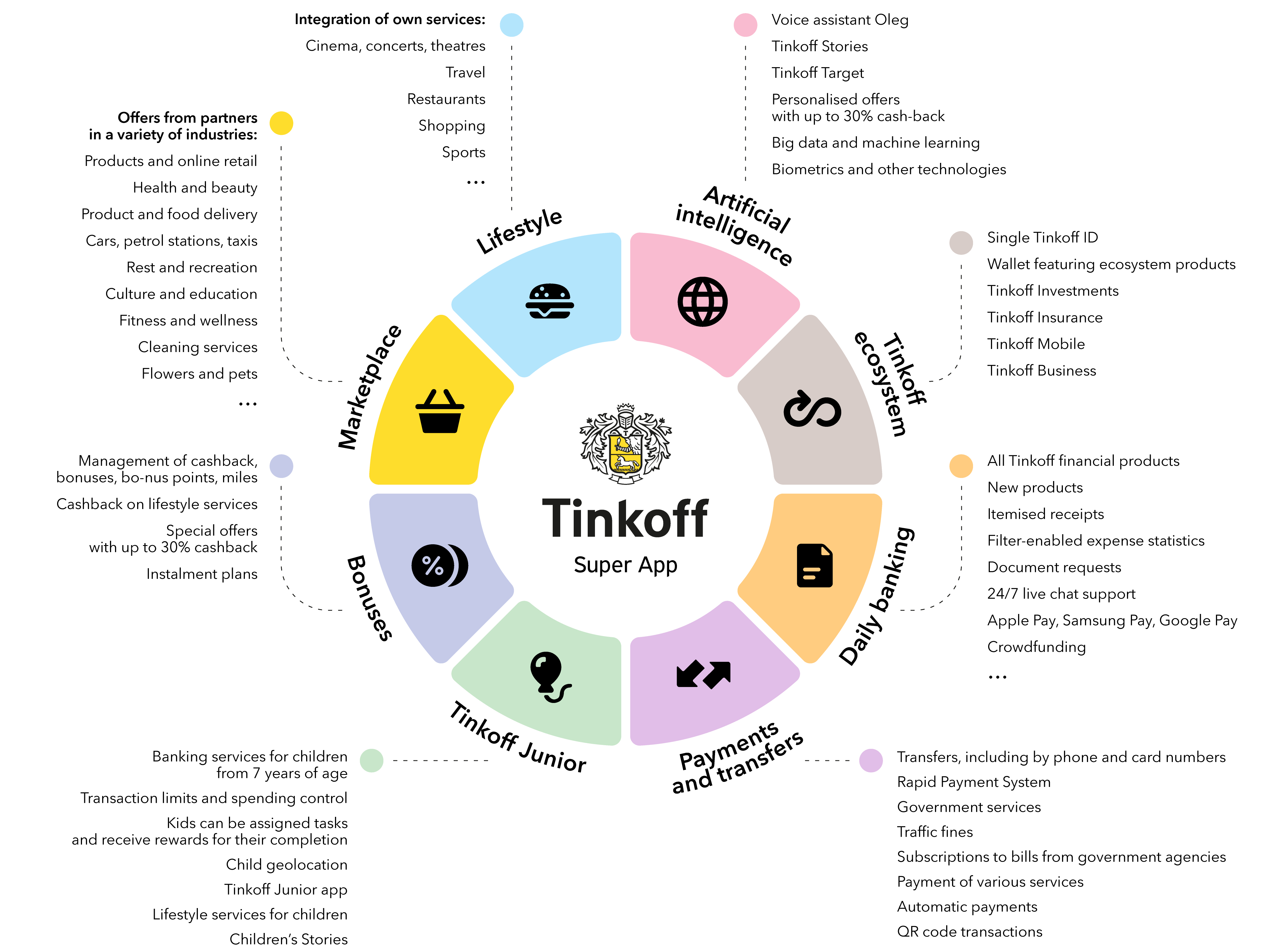

Other new entrants have come and gone, some still remain, some continue to emerge. PFM has a natural home within a neobank, with Tinkoff (whose eco-system is show below) and Revolut being prime examples of what either is or could become the much-vaunted ‘super-app’ – a single tool that manages all of a person’s financial life.

The specter of Open Banking, now very real, also opens up opportunities for PFM tools to be far more useful & embedded into our lives.

So…back to the original question.

What should or could a PFM-style app be doing to make itself sustainable and survive the PFM Graveyard?

Let’s have a look, noting that while I’m neither brave nor clever enough to attempt to build a PFM of my own, I’ve worked closely with many of them and have tried using & breaking plenty more.

How To Win in PFM (by someone who’s never build a PFM tool)

1. Offer Exponential Value

If I’m signing up for a PFM-type app, I’m going to be linking around 15 accounts to that app. That’s a lot of time & effort expending keying in my account details into tiny boxes, especially on a tiny screen, with fairly fat & clumsy fingers.

Notwithstanding what people may feel about the security of doing this (which is a topic for another discussion), this is a time-consuming and potentially frustrating endeavour, and one I, sure as heck, want to be rewarded for.

The value provided to effort expended is probably a bit skewed in the favour of most providers currently. The provision of other value-adding data like credit scores is a step in the right direction but, at present, it is just that. A step.

Spending insights are handy but they’re not especially sexy. Especially when the insights can’t always be trusted owing to issues with categorisation of transactions.

I think giving people a dollar value of what could be achieved in savings or earning, or both, through using the app for a year would engender major engagement and stickiness.

A big baseball bat between the eyes (not literally) to really make people sit up and take notice of what you’re going to do for them in terms of growing wealth or cutting costs.

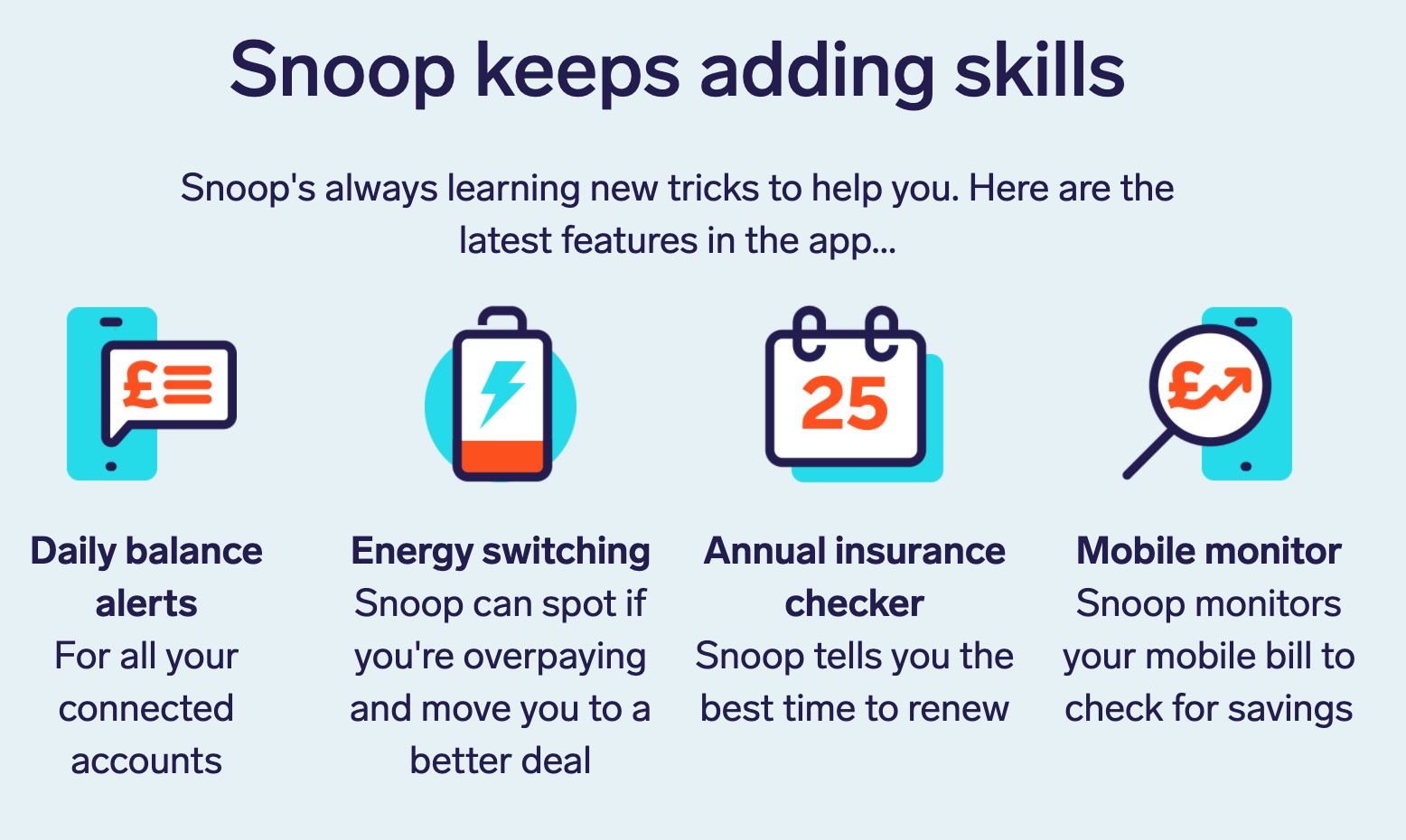

Snoop in the UK has taken this approach, albeit fairly cautiously, using Open Banking to underpin the data collection. Their claim is that they can save the average household $1,500 (Great British pounds, that is) per year.

The rationale for this slow-and-steady approach makes perfect sense: not to oversell the proposition and also cover bases in terms of any regulation issues or people coming back to them claiming false promises and such. It’s a great concept that, although fairly early, is going down a storm with consumers.

Modelling out the ‘lazy tax’ over a year and then facilitating helping folks avoid it ticks all the boxes.

Closer to home Humaniti offer their users the chance to earn money in exchange for answering (fairly simple and quick) surveys. My cup does not yet runneth over from answering these surveys but the ‘data dividend’ is an interesting idea.

2. K.I.S.S

The financial apps I love the most are the most simple. Period. [I wrote a blog about that – it’s here.]

Single feature or use-case apps are great because there’s only one problem to show & solve. The conundrum for them is that you might need 5-10 individual apps to cover all your financial bases, hence the need for a PFM-type tool, or a super-app.

The conundrum for PFMs is that trying to distill data & insights from up to 15 accounts (perhaps I’m not a typical user, but still) into a clean, simple dashboard on a mobile phone screen is really, really hard. If it was easy, everyone would’ve done it. Right?

A “busy” screen that’s hard to decipher is off-putting for even the most die-hard loyalist.

For a long time I’ve been dreaming of an I-Pod-style touch-screen showing one function / feature at a time, that can be swished on and off the screen with a sweep of the finger, thus keeping each individual display screen fairly simple and easy on the eye.

This would be extremely expensive to design & build, and, alas, I am neither clever nor brave enough to run a start-up myself so it remains just that, a frustrated little dream ensconced in some Balsamiq mock-ups…sigh.

3. Stack The Growth Deck

“If you build it, they will come,” is probably not the approach to take with a Fintech app (unless you’re lending money (or deferring payment).

Hitting a critical tipping point for success requires a confluence of things: piqued interest, downloading of app, signing-up, sharing credentials (regardless of how this is done). All these things take time and effort on behalf of the user, and given the average app-user’s attention span is roughly nine seconds (marginally less than that of a goldfish), there’s not much margin for error.

This means you need a veritable tsunami of traffic, marching a path to your door, demanding to be let in. And then once they’re in, you have to offer up your exponential value (see #1).

After all, there’s no point having a killer app that nobody knows about. And there’s definitely no point spending the dollars to get people to your app if the results underwhelm them.

Mint itself is (several) case studies in virality, my favourite being this one by Neil Patel.

Closer to home, there are relatively few consumer-facing FinTech apps that have nailed it when it comes to viral growth, but a few that spring to mind immediately are Raiz (aka The App Formerly Known As Acorns), Spriggy and Pocketbook, the first two not being PFMs, per se, but I see them as relevant use-cases.

Each approached their marketing / growth very differently, yet have been wildly successful.

Raiz had a few tailing winds (established US product, first-mover advantage etc) but executed flawlessly with a beautiful app from the get-go and a super-slick PR blast that earned them circa 40,000 salivating customers in a month or two after launch – the kinda numbers of pink-fluffy-cloud dreams.

Pocketbook had growth-hacking genius, Bosco Tan, at the helm, and actually used minor weaknesses in the product (such as its transaction categorisation) to bolster engagement and create customer “stickiness” and engagement.

Spriggy’s initial growth journey I know less about, except to say a dearth of competition (Dollarmites are, like, so 2004), rabid word-of-mouth adoption and a savagely low CAC, combined with savvy product tweaks all combined to bolster the following amongst new & old customers.

The other thing I know is that Spriggy is loved in our household, spoken about in hallowed tones, more like a friend or older brother than a bank account. It’s bizarre if you give it too much thought, but it works.

All were disruptive and cool and Fintech-y before Fintech was fully cool. Each hit the magic number of circa 100k users fairly quickly.

All were eminently likeable, a key trait called out by Robert Cialdini in his seminal book ‘Influence – The Psychology of Persuasion.’

And all had a….see #4….

But before moving on, it’s worth touching on another way of lighting the blue touch paper for a consumer (commercial, for that matter) finance app, and that’s to build an early customer base & ensuring loyalty by giving consumers the chance to invest in the business and share the journey.

Xinja, Douugh and Parpera have all run wildly successful equity crowdfunding campaigns on the Equitise platform and in doing so have, in the case of Xinja, and are likely to, in the case of the other two, built substantial early customer bases and generated a huge amount of awareness and PR – great for getting out of the gate with a bang and not a wimper.

Xinja quickly romped to circa 300k deposit-making customers, its customers lauding the company in forums and Facebook groups for the new and transparent way of banking being presented. A number of neobanks around the globe have been massively impacted by the ‘rona so it will be interesting to see what develops in this space.

Douugh will be less encumbered by the rigours of obtaining and maintaining its own banking license and could easily lay claim to PFM-esque credentials based on its product roadmap.

In the UK, the aforementioned Snoop and the un-aforementioned Chip have both been to ‘the crowd’ for both investment and customers and have both ‘gone off.’

4. Have A Point Of Difference

A trap that a number of PFM-providers have fallen into is that of homogeneity. I open the app and within seconds I could be in any one of half a dozen other, similar apps.

Account balances? Check.

Categorised transactions? Check.

Spending trends & insights? Check.

Credit score (usually from Experian)? Check.

This is because, as I’ve alluded to, it’s really expensive (circa $1m, I was quoted by a Fintech CEO who’s done it) to build a super-flashy app, even more so if the app itself is not your raison d’etre, and for true PFM functionality there can be an awful lot of data to display and to do this isn’t easy.

Pocketbook, as a first cab off the rank and with a maverick spirit, offered something immediately different, and this resonated with an audience hungry to get more closely aligned with its spending.

Frollo began its life as a “purpose-led Fintech” whose simple objective was to “make people feel better about money.” The design of the app was, and even more so now following a recent rebrand, feels very congruent with the mission.

This is supported by the amount of debt reduction being seen across Frollo-ers’ accounts.

Some of the newer entrants are recognising this and combining their PFM-features with lending products to create an immediate revenue stream (which is often the toughest hurdle for PFMs) taking advantage of our hard-wired desire for having stuff now that we can’t quite afford. It will be interesting to see where the focus lies once the lending dollars start rolling in.

Summary

So where does this rambling point us in trying to second-guess the fate of PFMs?

Here’s what I think could happen…

1. Neobanks that do everything have an unfair advantage, especially those on other people’s license. They are in the box-seat to own this space – think: Revolut & Tinkoff.

2. Open Banking (the elephant lurking in this room, for sure) will make more people comfortable with & able to switch easily & readily so comparison sites offering this are well placed.

3. Partnerships between established PFMs and larger organisations with innovation teams will flourish. A cool app + large-scale distribution quickly solves the ‘how to get to 100k customers’ conundrum.

4. Credit providers wearing a PFM cloak will create stickiness / daily usage amongst & by its users in an almost viral fashion. Think: BeforePay (formerly Cheq).

5. Gamification, hyper-personalisation and ‘self-driving finance’ (facilitated by Open Banking with ‘write’ access (i.e. the ability to make consented payments) will all be ubiquitous but not within the next 5-10 years.

And, that’s a wrap. I’m exhausted. And also, after this tl;dr monstrosity, far more optimistic that I was when I began this piece. Which has to something, right?

SFD