I’ll start by saying that this is going to get a tad messy. This article…

5 Ways The World Is Ripping You Off – And What To Do About It

Everyone is out to rip you off these days. There are vultures everywhere.

As Ferris Bueller wisely said: “Life moves pretty fast. If you don’t stop and look around once in a while, you might miss it.”

The same applies to your finances, too.

If you don’t stop every now and again, then you’re in danger of moving through life like a zombie blithely paying the fees and charges that corporate “the universe” decides it’s gonna hit you with.

Some of these jabs are stealthy; they sneak up on you over 20 years and before you know it you’re half a million dollars worse off and living on a state pension and corned beef out of a can becomes a weekly treat.

Others are downright blatant, as in: ‘slap you in the face with a wet fish’ blatant. And, yet, we still fall for it.

To save you getting royally rodgered, here are some obvious ones to look out for.

1. Overpriced Leisure-Wear

Exhibit A: cycling shorts or sports under-shorts.

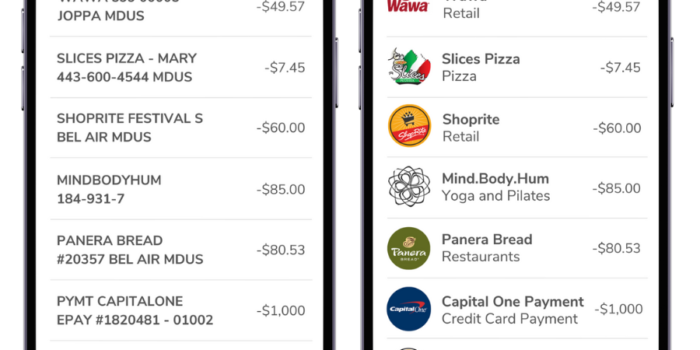

On the right are a pair of 2XU shorts (we could sub in Skins here is we chose to). On the left is a pair of Aldi shorts.

Now you’re approaching Dad-age, these become virtually mandatory if you want to avoid injury.

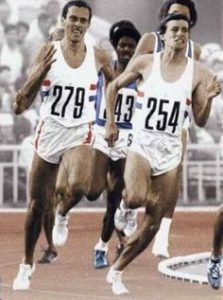

The days of free-balling around like Seb Coe or Steve Ovett in the 1980 Olympics 800m final are loooooong gone.

And here’s the rip-off. You go into a general sports store to buy a pair? And then you check the prices on Aldi.

Aldi = $14

Skins / 2XU = $94

6 x more expensive. Or 670% more expensive.

Either way. It’s an absolute rort.

Take that $80 price difference and assume you buy a pair per year for the next 10 years….

$1263 over 10 years by investing the difference in the price of the two pairs of shorts. And make 6-7%.

Just by buying cheaper under-shorts. That nobody ever gets to see.

And before you cry out in protest: but it’s all about the quality when I’m playing sport / exercising.

I retort, skeptically: I’ve worn both brands during the course of a soccer season and there’s no discernible difference.

If anything, the Aldi ones are better.

German manufacturing and all that (I know, they’re not actually made in Germany).

[Note: thankfully I got the 2XU at a warehouse sale a few years ago for $30].

2. The Big 4 Banks In Australia (and big banks anywhere else)

You tweet your displeasure at their ridiculously bad and outdated processed.

They tweet back with a phone number. Saying: please call; we’re so sad you had a rough experience.

You think: this is progress. They actually care about me.

The number is for a call centre. It could be offshore.

You realise that, whilst you care about your application, they don’t.

Could not give a flying fuck.

Seriously, what do the Big 4 offer anyone apart from convenience?

They make $9bn a year and charge you to have a current account.

And pay 0.01% interest on a current account.

[p.s. I like Commonwealth Bank. They seem the least bad].

3. The Big 4 Banks # 2

They pay you 2% interest on your savings.

You pay them 18% on your credit card and 12% on a personal loan.

They make A$9bn in profits.

You’re struggling to make $9 into a meal for four.

Seriously, vote with your feet and bank somewhere else.

They won’t notice or care, but you’ll feel better and less of a sucker.

4. Amazon Shipping To Australia

What is going on with this?

Do they think they’re shipping to Mars?

5. Superannuation / Funds Managers Fees

$20bn per year. That’s how much we pay in fees in Australia for our superannuation.

In the US the fees milked by all fund managers each year amounts to $1.7 trillion.

These are funds managed by highly-paid fund managers who often underperform the market. Or perform the same as the market.

But don’t just take my word for it. Read about it here:

Australian General Equity Funds: In 2015, the S&P/ASX 200 recorded a small return of 2.6%. Over the same period, the majority of Australian large-cap equity funds (63.8%) outperformed the benchmark, with an equal-weighted average gain of 3.9%. However, only 32.8% of funds in this category managed to beat the benchmark over the five-year period.

Yep, only 32% of Australian General Equity Funds (thats share-based funds to you and I) outperformed the index over 5 years.

That means you could save yourself the fees and invest in the index.

Like Warren Buffett. The 3rd richest man in the world.

But, no, we’re coerced from an early age into work-provided super funds and we let them take care of it.

Which translates loosely as “paying for their BMWs and their Breitlings (if they have taste enough to choose a Breitling. Which I doubt].

And their plush offices which impress you if you ever go in to visit them.

What a freaking rort.

6. Daycare Fees

You have a kid and within a year (if you live in Sydney) you’ll have to put him or her into daycare.

And the bunfight actually starts when they’re around three months old and you have to get on the waiting lists.

Hold on.

Waiting list?

For a fucking baby?

Yep. And you need to get on four or five to stand a chance of making one.

But wait.

You have to pay to get on the list. Sorry, lists.

Pay to go on waiting lists? Are you fucking insane?

‘Fraid not, sunshine.

And you’re praying that he gets into one that looks like a refugee camp with kids standing at the fence in their own shit, looking desperate to escape.

The one that costs $60 per day.

But the Mrs wants the whizz-bang one that “Amanda” sends her kids to, that’s like a resort for babies?

That one’s $155 per day.

Guess which one wins?

The kid goes to Disney Land every day for the “bargain” price of $27,000 a year.

Turns out Amanda’s husband owns half of the world which is how they can afford to send all their kids there.

You own half of a Toyota Corolla.

You’re screwed.

Still, at least you’ve got 5 years to get used to the ‘school’ fees before you actually have to start paying proper school fees.

Wonderful.

Conclusion

Some thing are worth paying top dollar for, no doubt about it.

In truth, the ‘resort for babies’ is an amazing place with amazing staff; somewhere you feel comfortable about leaving the little one all day, knowing that he’s being nurtured & looked after, fed & watered, and, bizarrely, given that he’s 2 years old, learning French.

But other things are definitely not.

And, whilst, the aggro involved in changing up things like bank account or pension-funds can almost (only almost, mind) make them seem destined for the too-hard basket and create in you a resigned inertia, it can be mission-critical that we pick our battles and make sure we win them.

SFD

For more money-saving tips check out these two articles: best ways to invest up to $10k and the sneaky fees that fool us all.