I’ll start by saying that this is going to get a tad messy. This article…

The One Piece Of Financial Advice That ALL Of The Experts Agree On

I work in, or closely alongside, the financial sector and the sheer volume of ideas and opinions flying about the place is both exciting and bewildering.

But it means that, for the average punter like you or me, it’s completely flawed because we don’t know what to do with our money or where to put it to best effect.

There is an overwhelming information asymmetry that self-perpetuates because it serves the financial services industry best if we don’t ask too many questions. Or that, if we do have the temerity to scratch beneath the surface, then we are met with the exact opposite of a wall of silence; we become engulfed in some more paperwork and such dense product disclosure statements that we simply give up and go back to the default option.

But what if we herded up some of the brightest & best financial minds around (guys who have a generally high ‘trust’ rating in our collective psyche) and collated their advice.

Would we go for it then?

Well, we’ve roped in some heavy hitters from a range of backgrounds and levels of experience but one thing remains the same: their advice.

The Super Scam

Take superannuation (the good old Australian pension). This is, on the face of it, the greatest giveaway in history.

Your employer is legally obligated to set aside 10% of your salary into a pension fund because you aren’t deemed trustworthy enough to do it yourself and the Government doesn’t want you to be destitute in your old age.

This is insane(ly good). This sh*t doesn’t happen elsewhere to the same degree.

And yet. And yet, most of us take that money and deposit it in the ‘default’ fund with barely a glance. The money is subject to fees for things like ‘investment management’ and ‘administration’, some of which is legit.

But some of it is totally poxy.

You’re basically paying fees for some fund manager to underperform the market.

Yep, that’s right. Studies have shown that an untrained monkey could perform better than a lot of fund managers, especially if the monkey was au fait with index investing.

Superannuation fees in Australia are around $23bn per year which means we’re paying $23bn for someone to underperform the market. Every year.

And we keep on doing it.

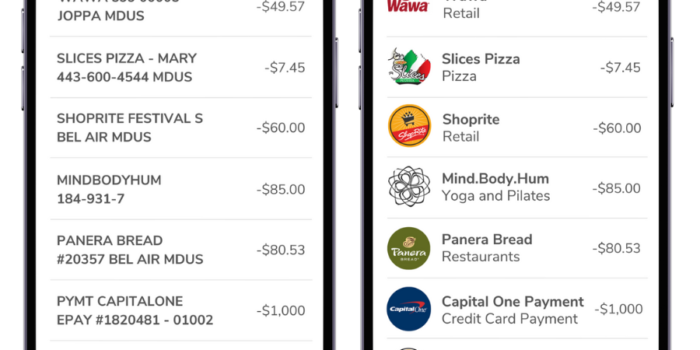

Here’s what paying 3% in your super could be doing to your nest-egg compared to your financiall savvy pal who is paying just 1%:

The impact of fees on fictitious ending account balance:

Jason: $100,000 growing at 7% (minus 3% in annual fees) = $324,340

Matthew: $100,000 growing at 7% (minus 2% in annual fees) = $432,194

Taylor: $100,000 growing at 7% (minus 1% in annual fees) = $574,349

Why do we keep falling for this BS?

Have you ever tried to change your superannuation fund. Or read your superannuation statement.

Jesus, even the so-called decent and transparent ones have thirty page product disclosure statements that make getting to the bottom of what exactly their fees & charges are like solving the The Fourier transform:

Nope, me neither.

The truth is ‘super’ is just an easy target; a bright pink pair of punching bags that I (and countless others) can slag off with a swift kick and an easy metaphor.

Regular investing is just as shady. Yet because in this case, we’re not forced to do it, most of us choose not to, instead sitting on a few sheckels at the bank paying a parsimonious 1.5%.

Or perhaps taking the plunge on a few well-chosen shares that our mates recommended down the pub.

There Is Another Way – Following The Financial Gods

The average stock-market investor makes around 3.3% return per year which is barely enough to cover the cost of inflation.

Yet the stock market itself historically has increased at an average rate of 9%.

And this is why every expert, no matter who they are, or what field they come at this from, recommends low-cost, index-linked funds as the way to go.

The Financial Hall Of Fame

The Barefoot Investor, Scott Pape, whose book I reviewed here has this to say about index funds.

Tony Robbins through interviews with Jack Bogle (founder of Vanguard who developed the index fund concept), amongst others, for his book ‘Money – Master The Game’, says this:

From 1984 to 1998 — a full 15 years — only eight out of 200 fund managers beat the Vanguard 500 Index.

So instead of buying all the stocks individually, or trying to pick the next high-flying hotshot fund manager, you can diversify and own a piece of all 500 top stocks simply by investing in a low-cost index fund that tracks or mimics the index.

One single investment buys you a piece of the strength of “American Capitalism.” In a way, you are buying into the fact that over the past hundred years, the top tier companies have always shown incredible resilience.

David Swenson who oversees Yale University’s $24bn endowment fund took it even further, saying this:

“When you look at the results on an after-tax basis, over reasonable long periods of time, there’s almost no chance that you end up beating the index fund.”

Warren Buffet himself gave the following advice to LeBron James when he was sought out.

Guess what?

The Oracle of Omaha said athletes are often approached with investing ideas tied to restaurants or real estate, but James should buy a low-cost index fund, while also keeping a significant cash reserve — “whatever makes him comfortable.”

“Just making monthly investments in a low-cost index fund makes a lot of sense,” Buffett said.

He added: “Owning a piece of America, a diversified piece, bought over time, held for 30 or 40 years, it’s bound to do well. The income will go up over the years, and there’s really nothing to worry about.”

So why aren’t we all up to our knackers in index-funds?

Well, they’re not especially sexy, and they’re something of a slow-burn which doesn’t exactly rev the engine in a world addicted to gratificatione instantia.

Compared with an online shopping site that will deliver your shiny new trousers this afternoon, deflecting money away from that into a 20-year saving plan (albeit one that which reap massive rewards) is a tough sell.

Setting up an automated savings plan that squirrels money away each month is the way to go, based on the advice being proffered by the expert mentioned above (and countless others).

The day after payday is a great time to do it, before you have time to miss the dough.

Summary

This may not be new financial advice. In which case, keep doing what you’re doing.

And yet, I know from conversations with friends, that most of us aren’t doing this. At least, not regularly. Not yet.

But if you didn’t start doing this ten years ago, the next best time is now.

And which index funds should you be being?

Well, Vanguard is the name that will usually crop up first and with good reason. Their founder, Jack Bogle, created them back in 1976 (that was when the first retail index fund was introduced). Their name is trusted by the names mentioned above and that is good enough for me [you should do your own research, though, because I’m just a punter in all of this. Just like you.]

There are a bunch of indexes that can be tracked, however, but again going with the consensus, I’d look at either of these:

Vanguard Australian Share Index Fund

Vanguard International Share Index Fund

They track the main stock market indexes so there’s no fannying around. They need around $5k to get started and you can make monthly payments. The costs here in Australia are a massive kick in the nuts – around 0.7% per annum compared to around 0.2% if you live in the US – but that seems to be the way with most everything over here.

Irrespective of that, check them out, read the PDS (product disclosure statement), see what their main holdings are (will mirror the index, obviously) and check out past performance & costs.

SFD